When a potential purchaser of a used automobile from CarMax doesn’t qualify for financing, they’ll probably be provided a mortgage from Exeter Finance as a lender of final resort. By way of its partnership with the nation’s largest used automotive retailer, Exeter positioned itself on the pipeline of sub-prime debtors, in accordance with a ProPublica report. The lender would then use doubtful extensions to stretch out mortgage durations and squeeze the poorest borrows for unbelievable sums of cash.

Most Exeter loans are opened by means of CarMax, and ProPublica highlighted one sub-prime borrower for instance the financial state of affairs of somebody taking out this sort of mortgage. Jessica Patterson purchased a $15,000 Kia Rio in 2017 from a CarMax exterior of Kansas Metropolis, Kansas. She was a receptionist at a listening to support gross sales heart, making $12 an hour and had simply moved out of a home violence shelter. ProPublica explains:

Like most subprime prospects, her credit score historical past was rife with unpaid payments. The money owed have been largely from her ex-husband, she mentioned.

The CarMax worker mentioned she had excellent news, although: Exeter would lend Patterson the total quantity wanted to purchase the Kia. Then the worker learn the mortgage phrases aloud. A six-year mortgage. A 25.17% rate of interest. A month-to-month fee of $402.63. That may be 1 / 4 of Patterson’s take-home pay, nearly twice what client finance consultants advocate.

She requested whether or not there have been cheaper presents. Not one of the different firms have been keen to provide Patterson a mortgage, mentioned the worker, who turned her laptop monitor so Patterson might see. “Exeter was the one one there,” she mentioned. Based on score company stories, CarMax is the only largest supply of Exeter’s enterprise — answerable for some 50,000 loans per 12 months.

Patterson agreed to the phrases. To get to work and get her youngsters to high school, she wanted a automotive. Turning down the mortgage felt like giving up.

The mortgage’s staggering rate of interest meant that Patterson would pay over $14,000 in curiosity to go away with the Rio, however she had no different possibility. She was conscious of this as a result of the quantity was printed on the mortgage because of the Reality in Lending Act, however once more, she had no different possibility.

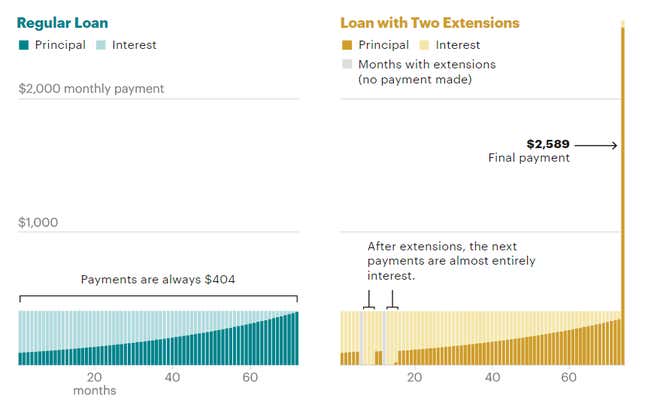

Patterson rapidly fell behind and requested two mortgage extensions by January 2018 as she took her household to free church dinners and visited meals banks to economize to make funds. At first look, Exeter might sound beneficiant in providing aid however the change heaps much more debt onto debtors by means of added curiosity. The report provides:

The corporate would merely transfer the December and January funds to the top of her five-year fee schedule, the consultant advised her, including two months to the mortgage’s time period. “It was prompt aid,” Patterson mentioned.

The extension appeared to be a courtesy from Exeter in a time of want. In truth, the corporate’s disclosures on the time acknowledged “Extension price: $0.00.”

The pause in funds, nonetheless, was something however free. What Patterson didn’t know, and what she mentioned Exeter didn’t inform her, was that each penny of her subsequent 5 funds would go to the curiosity that constructed up throughout the reprieve. That meant she didn’t pay down the unique mortgage stability in any respect throughout that point.

Whereas the extension allowed her to maintain her automotive, it added about $2,000 in new curiosity costs, which the lender didn’t clearly disclose.

Exeter ultimately repossessed the Kia Rio from Patterson in 2021 after amassing $17,097 over three years whereas she was over $11,000 in debt. The lender then auctioned off the Kia for $13,800. So many extra tales took the identical course as Jessica Patterson’s. Greater than 200,000 Exeter loans are not less than three funds delayed, and 1 / 4 of those loans usually finish with reimbursement stopping early.

You possibly can learn ProPublica’s full report right here to study extra about Exeter’s extremely questionable practices and the struggles of different debtors.