In case you’re like most Tesla homeowners, you’ve got most likely skilled a point of depreciation in your Tesla. However understanding why it occurs and how one can mitigate it may well make a big distinction in your possession expertise and total funding.

Tesla autos, like some other automotive, lose worth over time, however the elements contributing to this depreciation are distinctive in some methods as a result of speedy evolution of EV expertise, market dynamics, and Tesla’s personal pricing methods.

At Discover My Electrical we’ve seen, interacted with, and served quite a few Tesla homeowners who’ve skilled depreciation on their Teslas (with the individuals who purchased on the top of the provision chain constraints, in about spring 2022, getting the worst of it).

It’s laborious to see folks constantly lose cash on their Teslas, however this has change into a generally accepted a part of Tesla possession now. And whereas everybody is aware of that cars are depreciating belongings, Teslas (and to an extent, EVs normally), appear to be in a particular class right here. We’re very pro-Tesla at Discover My Electrical, however this depreciation curve is one thing that we expect is price writing about to assist inform consumers and sellers.

On this article, we’ll discover the precise depreciation developments for every Tesla mannequin, together with the Mannequin S, Mannequin 3, Mannequin X, Mannequin Y, and even the Cybertruck. We’ll break down why these autos are inclined to lose worth and supply sensible ideas that can assist you reduce depreciation in your Tesla. Whether or not you’re a present Tesla proprietor trying to shield your funding or a possible purchaser eager to make a sensible buy, this information will arm you with the information you want.

Why Do Teslas Depreciate & Lose Worth So Quick?

Tesla’s autos are well-known for his or her cutting-edge expertise, efficiency, and design. Nevertheless, regardless of their enchantment, Teslas—like most autos—depreciate over time.

However what units Tesla aside is the distinctive set of things that affect how rapidly their autos lose worth.

Let’s dive into the first causes behind Tesla’s speedy depreciation:

- Frequent Worth Changes

One of the vital vital elements contributing to Tesla depreciation is the corporate’s frequent and unpredictable value changes. Tesla has a historical past of altering the pricing of its autos, usually with out a lot discover. This is usually a double-edged sword: whereas it would make Tesla autos extra accessible to new consumers, it may well additionally result in a sudden drop within the resale worth of Teslas bought at the next value level.

For instance, if Tesla decides to cut back the value of a Mannequin S by $10,000, homeowners who purchased the automotive earlier than the value drop may see the worth of their automobile plummet nearly in a single day. These value changes are sometimes pushed by adjustments in manufacturing prices, provide chain dynamics, and Tesla’s technique to remain aggressive available in the market.

This was at its worst in spring 2022, when for those who might get your fingers on a Mannequin Y Lengthy Vary, you can instantly flip it for a $5k revenue. Throughout that point, members of the Discover My Electrical crew did a couple of podcasts, the place we cautioned that this wouldn’t final without end (and it didn’t).

Tesla was merely attempting to anticipate the provision chain curve and didn’t need to ship autos later that they might lose cash on, in order that they quickly needed to overprice them (even Elon has famous this).

As soon as the provision chain obtained higher, Tesla dramatically minimize costs, and everybody was left holding the bag. The worst of this, are individuals who purchased Mannequin S Plaids, for $150k+, and now have misplaced about 60% of their automobile worth in only a couple years, which actually hurts.

- Speedy Developments in Expertise

Tesla is thought for pushing the boundaries of automotive expertise. From Autopilot to battery improvements, Tesla autos usually characteristic the most recent in EV tech. Nevertheless, this fixed innovation signifies that newer fashions usually outshine their predecessors, resulting in quicker depreciation of older autos.

For example, Tesla’s over-the-air software program updates are a key promoting level, however in addition they imply that the latest fashions are often extra superior than these launched only a 12 months or two earlier. As new options and enhancements are launched, older fashions can really feel outdated extra rapidly, which impacts their resale worth.

It’s well-known that Tesla doesn’t wait to launch {hardware} updates or enhancements on autos, they only roll them out in actual time. Which means for instance, the brand new Mannequin S plaid seats—as soon as these dropped, the older Plaids with out them had been price barely much less; this occurs loads with Tesla, and whereas it is sensible for brand spanking new autos, it results in them depreciating quicker.

- Individuals Are Nonetheless Nervous About Proudly owning EVs Out of Guarantee

A major issue contributing to the depreciation of Teslas is the priority many consumers have about proudly owning an electrical automobile (EV) after the guarantee expires. Not like conventional inner combustion engine autos, the place upkeep and restore prices are extra predictable and well-understood, EVs introduce a degree of uncertainty, notably round battery life and alternative prices.

Tesla’s batteries are designed to final a very long time, and have a very good guarantee, however the potential for a pricey restore or alternative outdoors of guarantee can deter consumers, driving down the resale worth of older Teslas. Moreover, the complexity of Tesla’s software program and the reliance on over-the-air updates signifies that some consumers concern they may encounter costly or difficult-to-fix points as soon as the automobile is out of guarantee. This hesitation can result in a steeper depreciation curve because the automobile ages and strikes past its guarantee interval.

- Shifting Client Preferences

Whereas Tesla’s Mannequin Y grew to become the best-selling automobile globally in 2023, the broader EV market continues to be topic to fluctuating shopper preferences. These shifts can create durations the place EVs, together with Teslas, are both in excessive demand or expertise slower gross sales. Regardless of Tesla’s robust model and revolutionary expertise, there are occasions when exterior elements like financial circumstances, adjustments in authorities incentives, and even the discharge of recent fashions from rivals can quickly affect shopper curiosity in EVs.

For instance, when fuel costs spike or new environmental laws are launched, there could also be a surge in demand for EVs, driving up costs and slowing depreciation. Conversely, when incentives are diminished or shopper consideration shifts to the most recent tech gadget, curiosity in EVs may wane barely, resulting in a faster drop in worth. Whereas Tesla continues to dominate the EV market, these ebbing and flowing shopper preferences play a job in how briskly their autos depreciate.

- Uncertainty Round Full Self-Driving (FSD)

Tesla’s Full Self-Driving (FSD) characteristic is a big promoting level for a lot of consumers, however it additionally introduces a degree of uncertainty relating to depreciation. FSD continues to be in a state of improvement, and the timeline for its full rollout stays unclear. Consequently, the perceived worth of FSD can fluctuate, impacting the resale worth of Teslas outfitted with this characteristic.

If FSD doesn’t ship on its promised capabilities inside an inexpensive timeframe, or if regulatory challenges delay its implementation, the worth proposition of proudly owning a Tesla with FSD might diminish, resulting in quicker depreciation for these fashions.

That is additionally except for the truth that FSD merely doesn’t retain its worth within the used market. So, on the time of writing, FSD prices about $8,000 to be paid in full, however is barely price $1,000 – $2000 on the used market. Whereas we positively assist Tesla’s mission on fixing FSD and autonomy, for those who’re trying to keep away from depreciation, don’t pay for FSD in full.

Tesla Mannequin S Depreciation

The Tesla Mannequin S has been a flagship of the model since its introduction in 2012, embodying the posh, efficiency, and cutting-edge expertise that Tesla is thought for.

Nevertheless, regardless of its many accolades, the Mannequin S will not be resistant to depreciation (actually, it’s mainly the worst of all Teslas for those who consider the Plaid). Understanding the precise elements that affect its worth over time may also help present homeowners and potential consumers make knowledgeable choices.

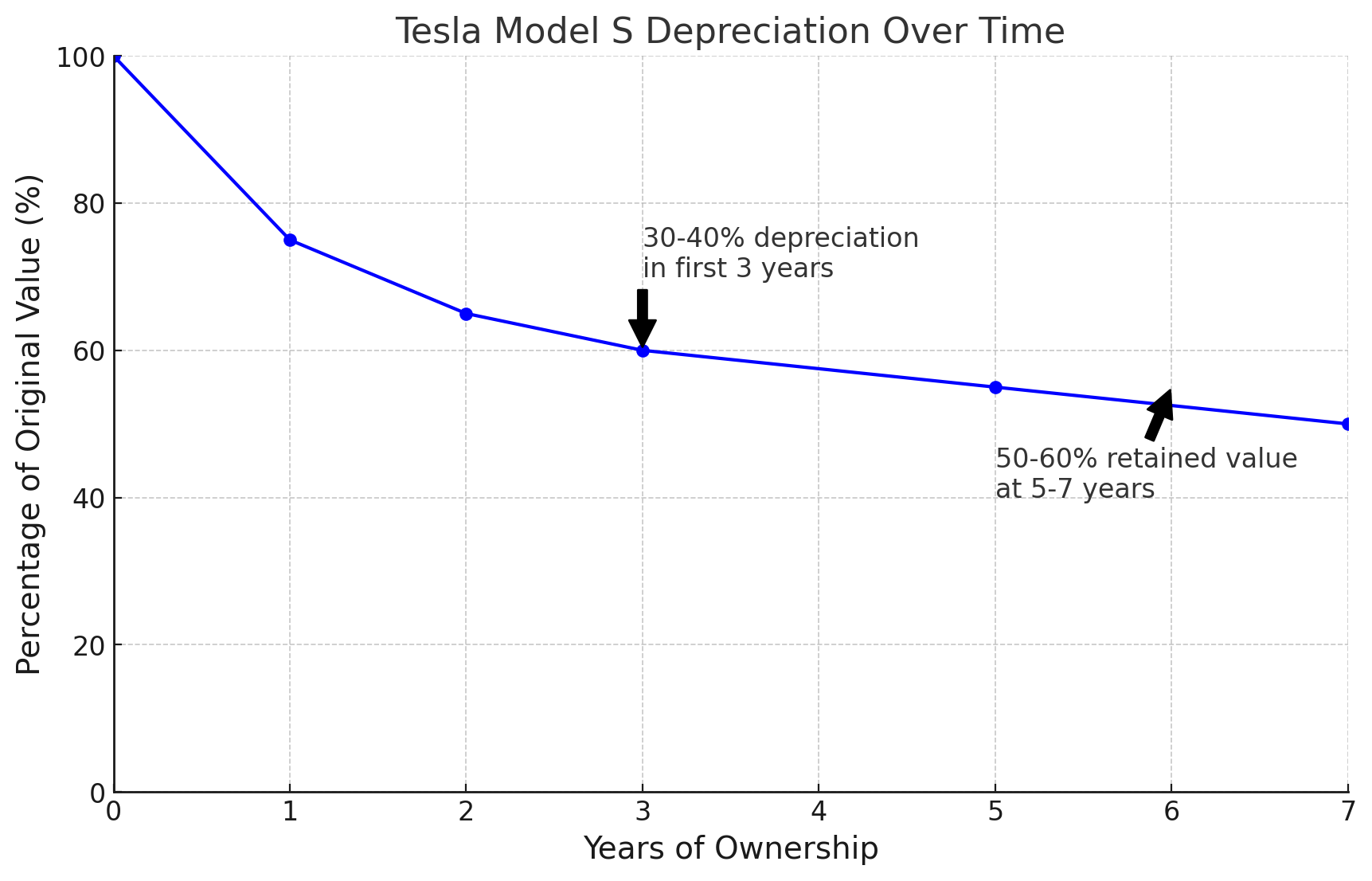

Preliminary Depreciation

Like most luxurious autos, the Tesla Mannequin S experiences vital depreciation inside the first few years of possession. On common, a brand new Mannequin S can lose between 30-40% of its worth inside the first three years. This steep preliminary depreciation is typical for high-end autos, the place the market is smaller, and consumers are sometimes in search of the most recent and best options.

For example, a Mannequin S that initially retailed for $100,000 may be valued at round $60,000 after three years. This speedy depreciation is pushed by a mixture of things, together with the introduction of newer fashions with upgraded options, frequent Tesla value changes, and the final depreciation development for luxurious autos.

Expertise Developments

The Mannequin S has seen quite a few updates and iterations over time, from battery enhancements to inside upgrades and software program enhancements. Whereas these developments maintain the Mannequin S on the forefront of EV expertise, in addition they contribute to depreciation. Older Mannequin S variants rapidly really feel outdated as newer variations hit the market with higher efficiency metrics, longer vary, and extra superior options (simply have a look at the rounded nose-cone older Mannequin S variants for those who want proof of this).

For instance, the introduction of the Plaid model in 2021, with its unparalleled pace and new inside, prompted earlier Mannequin S variations (P100D, Efficiency, and many others.) to drop in worth. Patrons in search of essentially the most superior expertise may go for the most recent mannequin, leaving older variations to depreciate extra quickly.

Influence of Provide Chain Disruptions

The Mannequin S was not resistant to the provision chain disruptions that plagued the automotive business, notably in the course of the COVID-19 pandemic. These disruptions led to delays in manufacturing and deliveries, which quickly inflated costs for obtainable autos. Nevertheless, as manufacturing normalized and new models grew to become extra available, costs for used Mannequin S autos adjusted accordingly, contributing to a quicker depreciation fee for individuals who bought in the course of the peak of the provision chain disaster.

Market Notion and Luxurious Car Depreciation

As a luxurious EV, the Mannequin S can also be topic to the final developments that have an effect on luxurious automobiles. Luxurious autos are inclined to depreciate quicker than their non-luxury counterparts on account of a smaller pool of consumers, larger preliminary prices, and the speedy tempo of technological change. For the Mannequin S, which means whereas it would retain worth higher than some luxurious manufacturers, it nonetheless faces vital depreciation, notably as newer Tesla fashions or aggressive luxurious EVs enter the market.

Resale Worth and Lengthy-Time period Depreciation

Lengthy-term depreciation for the Mannequin S tends to stabilize after the primary few years. A well-maintained Mannequin S that’s about 5-7 years previous can retain about 50-60% of its unique worth, relying on the situation, mileage, and any aftermarket upgrades. The Mannequin S tends to carry its worth higher in the long run in comparison with another luxurious autos, because of its model recognition and the power of Tesla’s supercharging community.

Nevertheless, it’s vital to notice that as Tesla continues to innovate and roll out new options, older Mannequin S variants might battle to maintain up with the most recent expertise, resulting in additional depreciation. Moreover, the out-of-warranty considerations mentioned earlier may play a big function within the long-term worth retention of the Mannequin S.

Tesla Mannequin 3 Depreciation

The Tesla Mannequin 3, launched in 2017 (has it actually been that lengthy?), was designed to be the extra reasonably priced and accessible choice in Tesla’s lineup, bringing the model’s cutting-edge EV expertise to a broader viewers. As the most well-liked Tesla mannequin by gross sales quantity, the Mannequin 3 has seen vital market penetration, which performs a job in its depreciation. Right here’s what it’s essential to learn about how the Mannequin 3 holds its worth over time.

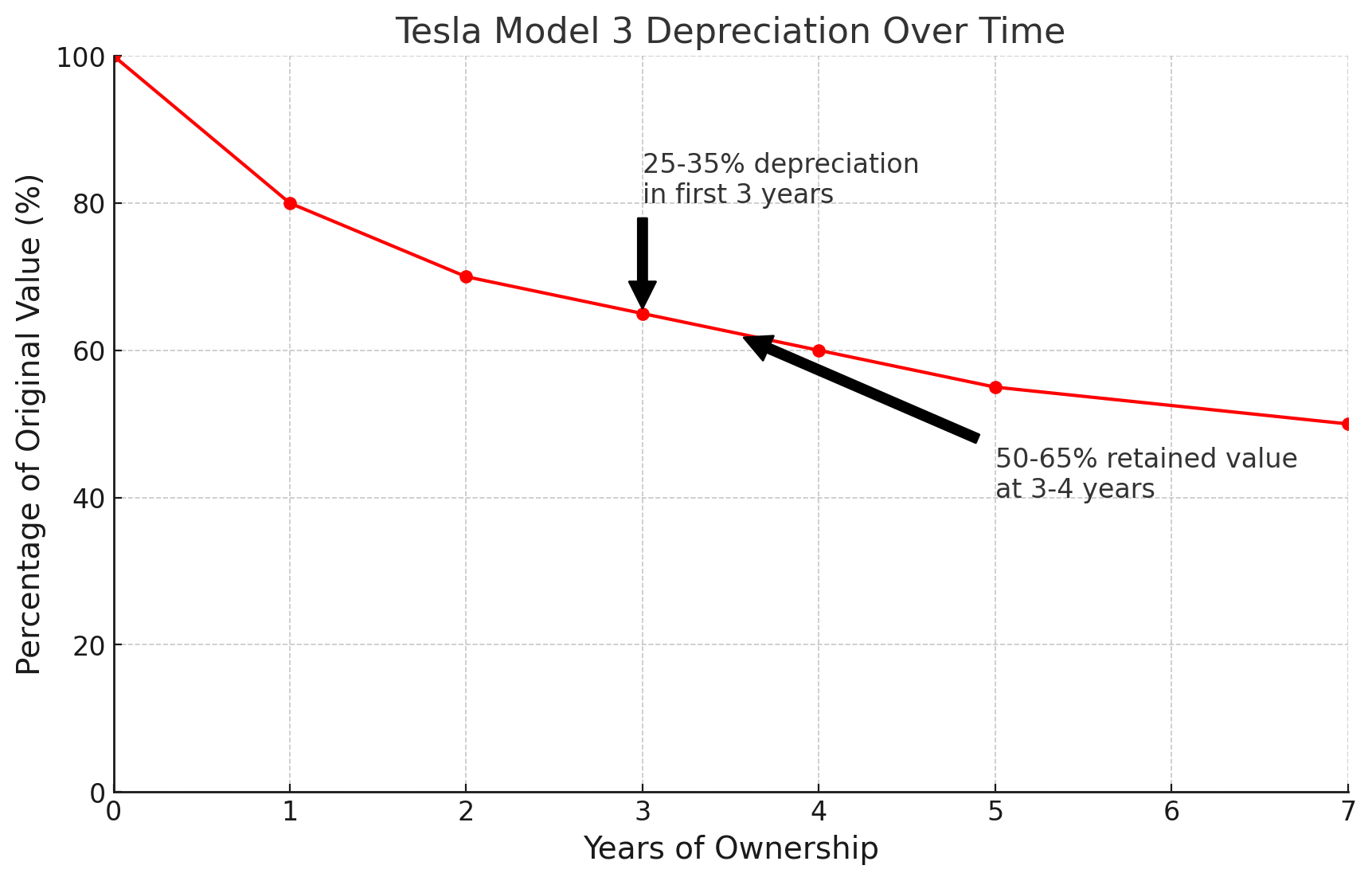

Preliminary Depreciation

The Mannequin 3 typically experiences a much less steep depreciation curve in comparison with luxurious fashions just like the Mannequin S, partly on account of its decrease beginning value and broader enchantment. On common, the Mannequin 3 loses about 25-35% of its worth inside the first three years of possession, which is comparatively modest in comparison with the business customary for autos in its value vary.

For instance, a Mannequin 3 that initially offered for $50,000 may be price round $35,000 after three years. This comparatively gradual depreciation fee is influenced by robust demand for used Mannequin 3 autos, Tesla’s model power, and the automobile’s repute for being a dependable and environment friendly EV.

Excessive Demand and Market Saturation

One of many causes the Mannequin 3 holds its worth properly is the sustained excessive demand in each new and used markets. The Mannequin 3’s reputation signifies that at the same time as new fashions enter the market, there’s a constant demand for used ones. Nevertheless, as extra Mannequin 3s are produced and enter the market, there’s a threat of market saturation, which might doubtlessly speed up depreciation sooner or later.

Within the used automotive market, the Mannequin 3 is commonly seen as a sensible purchase, providing most of the identical options and efficiency as newer fashions however at a decrease price. This excessive demand helps to maintain depreciation charges decrease than anticipated for a automobile at its value level.

This has been affected to a point although by the used EV tax credit score ($4,000 on qualifying autos), in addition to a flood of out-of-warranty 2018, 2019, and now 2020 Mannequin 3s getting into the market.

Influence of Frequent Software program/{Hardware} Updates

Tesla’s dedication to over-the-air software program updates is a double-edged sword for the Mannequin 3’s depreciation. On the one hand, these updates assist to maintain older autos updated with new options and enhancements, which may positively influence resale worth. Then again, main {hardware} adjustments, such because the introduction of recent battery expertise or design tweaks, could make older fashions really feel outdated, resulting in quicker depreciation (for instance, older autos that aren’t HW3 or HW4 succesful).

For example, the Mannequin 3 has seen a number of inside and battery enhancements since its launch, and every new iteration tends to barely cut back the worth of earlier fashions. Nevertheless, the general influence on depreciation stays average as a result of automobile’s ongoing software program enhancements.

Resilience In opposition to Financial Fluctuations

Apparently, the Mannequin 3 has proven a level of resilience in opposition to broader financial fluctuations. In periods of financial uncertainty, such because the COVID-19 pandemic, the Mannequin 3 retained its worth higher than many different autos. That is largely as a result of rising shift towards EVs, the robust model recognition of Tesla, and the associated fee financial savings related to proudly owning an electrical automobile.

Nevertheless, it’s price noting that whereas the Mannequin 3 has been comparatively resilient, vital financial downturns or shifts in shopper choice towards newer fashions or totally different manufacturers might nonetheless influence its long-term worth.

Lengthy-Time period Depreciation and Worth Retention

Lengthy-term depreciation for the Mannequin 3 tends to stabilize after the preliminary drop within the first few years. A well-maintained Mannequin 3 that’s 3-4 years previous can retain round 50-65% of its unique worth, relying on elements like mileage, situation, and any enhancements or updates.

The Mannequin 3’s continued reputation, mixed with Tesla’s robust model presence and ongoing developments in EV expertise, suggests that it’s going to proceed to retain its worth higher than lots of its rivals within the EV market. Nevertheless, as with all autos, elements akin to guarantee expiration and the introduction of newer fashions will inevitably affect its depreciation over time.

Tesla Mannequin X Depreciation

The Tesla Mannequin X, identified for its distinctive falcon-wing doorways and standing as a luxurious electrical SUV, has been a standout in Tesla’s lineup since its launch in 2015. Combining efficiency, superior expertise, and family-friendly house, the Mannequin X appeals to a particular phase of consumers in search of a high-end EV expertise. Nevertheless, as with all autos, the Mannequin X is topic to depreciation, and its distinctive traits play a job in how its worth adjustments over time.

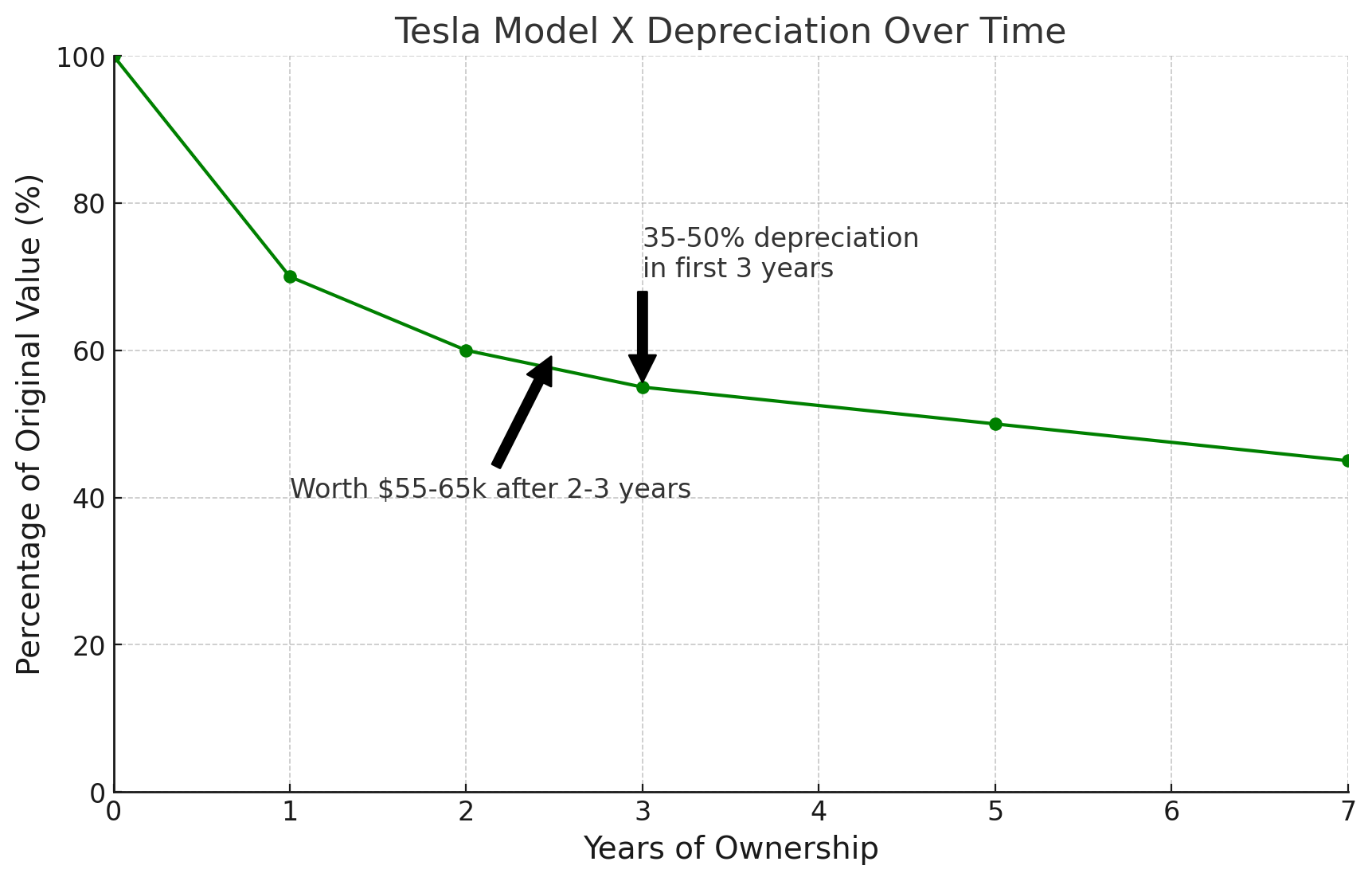

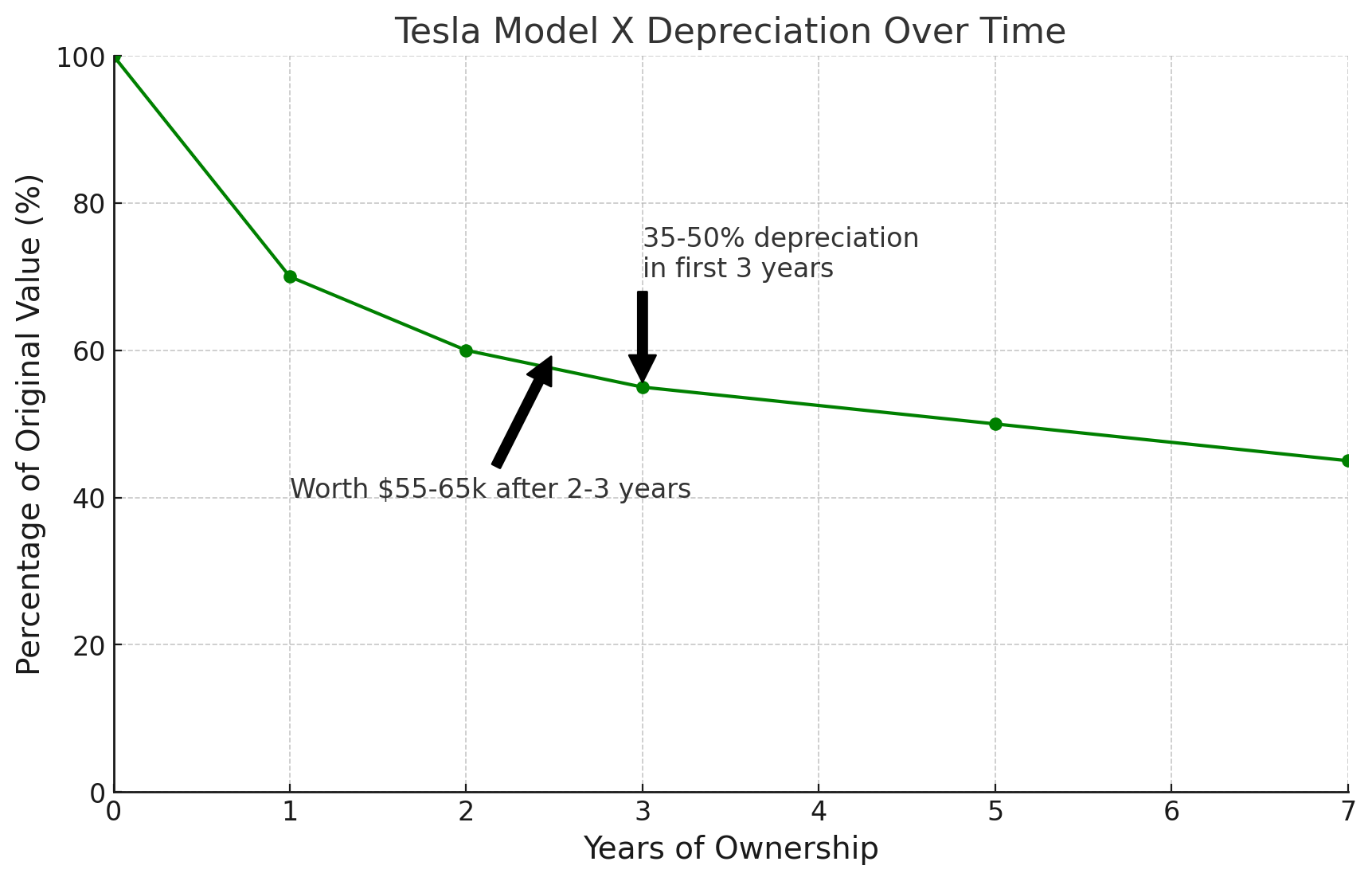

Preliminary Depreciation

The Tesla Mannequin X experiences vital depreciation throughout its first few years, very similar to different luxurious autos. On common, the Mannequin X loses about 35-50% of its worth inside the first three years of possession. This steep depreciation is typical of high-end SUVs, the place the preliminary excessive buy value signifies that the greenback quantity of depreciation is substantial. And for Plaid homeowners, it’s the worst on account of Tesla value cuts and different elements.

For instance, a Mannequin X that initially offered for $100,000 may very well be price round $55,000 to $65,000 after 2-3 years. This speedy depreciation is influenced by a number of elements, together with the introduction of newer, extra superior fashions, and the final development of luxurious autos shedding worth extra rapidly than non-luxury counterparts.

Luxurious Market Dynamics

As a luxurious SUV, the Mannequin X can also be topic to the broader dynamics of the posh automobile market. Luxurious autos are inclined to depreciate quicker than non-luxury autos on account of a number of elements, together with larger preliminary costs, a smaller pool of potential consumers, and the speedy tempo of technological change. For the Mannequin X, these dynamics are additional difficult by the EV market’s quick evolution.

Patrons of luxurious SUVs usually prioritize the most recent options, resulting in faster depreciation of older fashions. Moreover, as new luxurious EVs from different producers enter the market, the competitors will increase, placing downward strain on the resale worth of older Mannequin X autos.

Out-of-Guarantee Considerations

The Mannequin X is thought for its superior options and sophisticated engineering, together with its falcon-wing doorways and complex electronics. Whereas these options are a part of what makes the Mannequin X interesting, they may also be a supply of concern for consumers contemplating a used Mannequin X that’s out of guarantee. The potential for costly repairs, notably for distinctive elements just like the doorways or superior Autopilot methods, can deter some consumers and contribute to quicker depreciation as soon as the automobile is now not coated by Tesla’s guarantee.

Lengthy-Time period Worth Retention

In the long run, the Mannequin X tends to stabilize in worth after the preliminary steep depreciation. A well-maintained Mannequin X that’s 2-3 years previous can retain round 50-60% of its unique worth, relying on elements akin to mileage, situation, and the presence of any vital updates or aftermarket enhancements.

The Mannequin X’s worth retention is bolstered by its standing as one of many few luxurious electrical SUVs in the marketplace, providing a mixture of house, efficiency, and expertise that continues to be interesting to a distinct segment phase of consumers. Nevertheless, as newer fashions proceed to be launched and the posh EV market turns into extra aggressive, the Mannequin X might face further depreciation pressures.

Tesla Mannequin Y Depreciation

The Tesla Mannequin Y, launched in 2020, rapidly grew to become probably the most common autos in Tesla’s lineup, largely on account of its mix of practicality, efficiency, and value. As a compact SUV, the Mannequin Y appeals to a variety of consumers, from households to tech fans, and its reputation has solely elevated since its launch. Nevertheless, like all autos, the Mannequin Y is topic to depreciation, and understanding the way it holds its worth may also help consumers and homeowners make knowledgeable choices.

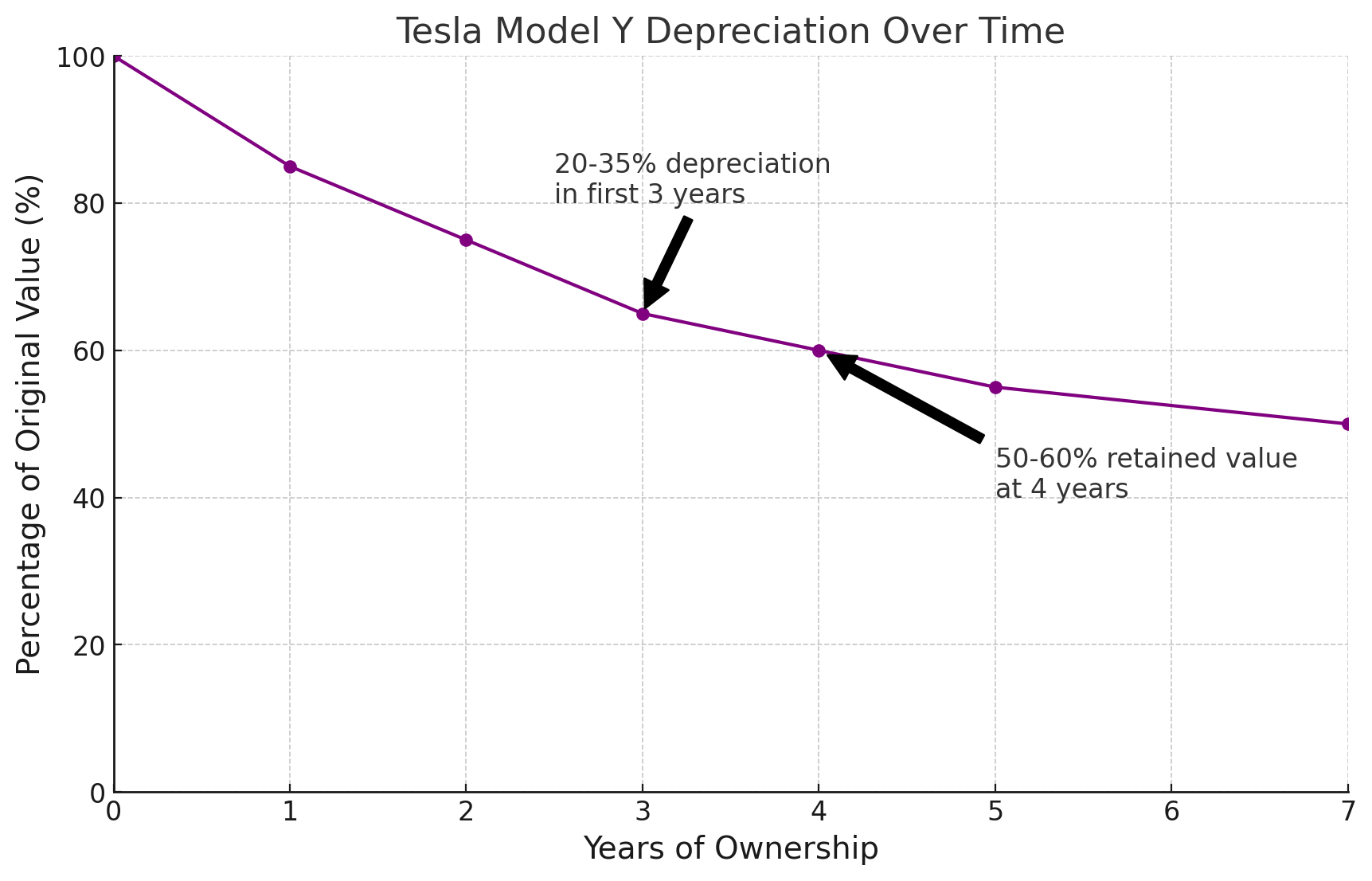

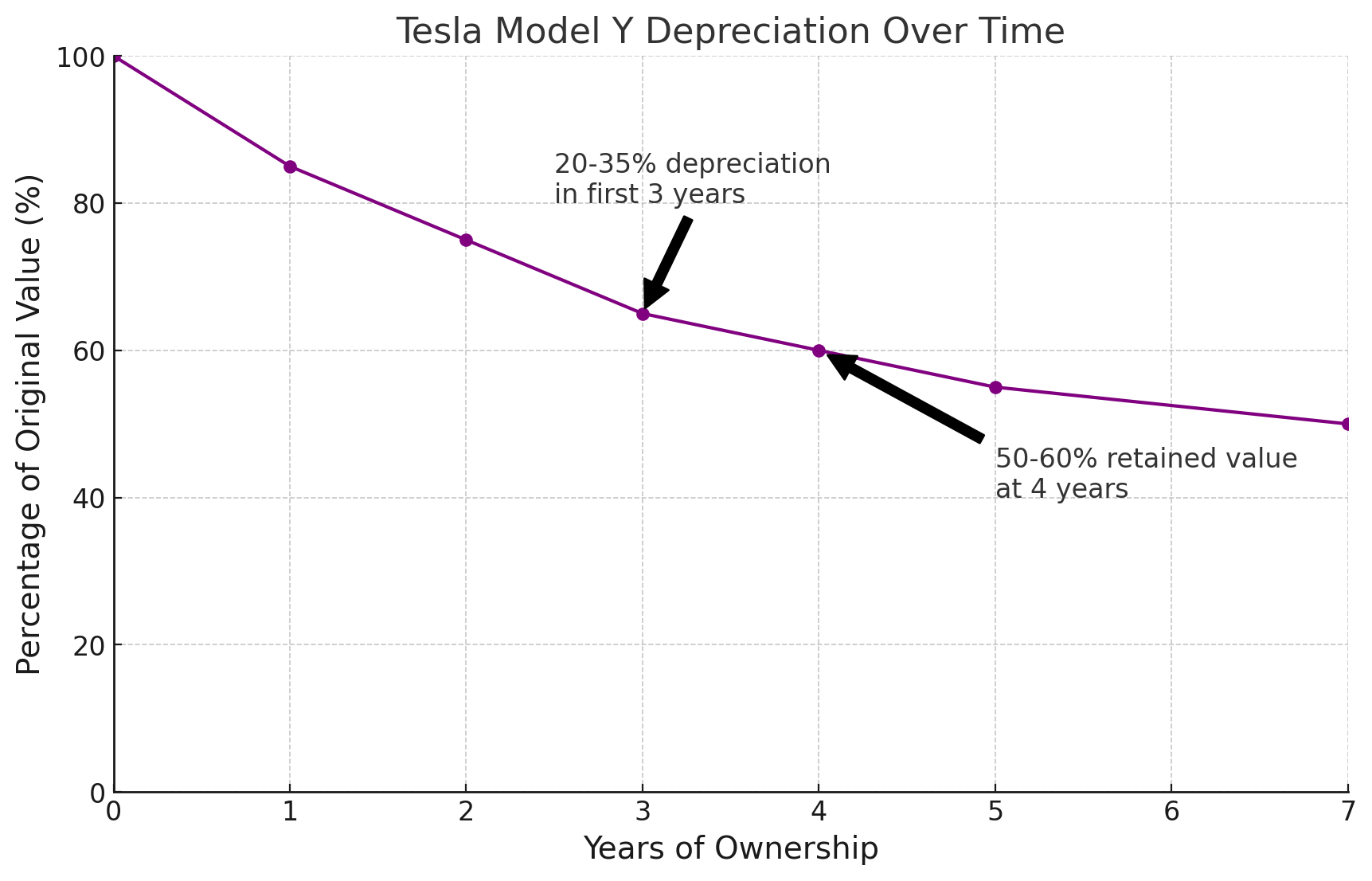

Preliminary Depreciation

The Tesla Mannequin Y experiences a comparatively modest depreciation fee in comparison with different autos in its class. On common, the Mannequin Y loses about 20-35% of its worth inside the first three years of possession. This slower depreciation is a testomony to the automobile’s excessive demand, robust model repute, and Tesla’s steady enhancements in expertise and efficiency.

For instance, a Mannequin Y that initially offered for $60,000 may be price round $40,000 – $45,000 after two years. The lower-than-average depreciation for a automobile on this phase displays the Mannequin Y’s broad enchantment and the rising demand for electrical SUVs.

Excessive Demand and Market Stability

One of many key elements contributing to the Mannequin Y’s decrease depreciation fee is its excessive demand. The Mannequin Y has constantly been one of many best-selling EVs globally, and its reputation reveals no indicators of waning. This robust demand helps to stabilize its resale worth, as there’s a giant pool of potential consumers for used Mannequin Ys.

Moreover, the Mannequin Y’s place as a compact SUV—a extremely fascinating automobile class—signifies that it advantages from a broader market enchantment than another EVs. This has helped the Mannequin Y preserve its worth higher than lots of its rivals, each inside the EV market and the broader automotive market.

Influence of Worth Changes on Mannequin Y

Tesla’s tendency to regulate costs often additionally performs a job within the Mannequin Y’s depreciation. Whereas these value changes could make the Mannequin Y extra accessible to new consumers, they’ll additionally have an effect on the resale worth of autos bought at the next value level. For example, if Tesla lowers the value of the Mannequin Y by a number of thousand {dollars}, the resale worth of older Mannequin Ys may drop accordingly.

Nevertheless, as a result of the Mannequin Y is positioned as a extra reasonably priced choice inside Tesla’s lineup, these value changes are inclined to have a smaller influence on depreciation in comparison with higher-end fashions just like the Mannequin S or Mannequin X.

Lengthy-Time period Worth Retention

In the long run, the Mannequin Y is predicted to retain its worth higher than many different autos in its class. A well-maintained Mannequin Y that’s 4 years previous can retain round 50-60% of its unique worth, relying on elements akin to mileage, situation, and any vital updates or enhancements.

The Mannequin Y’s robust resale worth is pushed by its ongoing reputation, the increasing EV market, and Tesla’s repute for producing dependable, high-performing electrical autos. As Tesla continues to innovate and enhance its autos, the Mannequin Y is more likely to stay a stable alternative for consumers in search of a automobile that holds its worth properly over time.

Tesla Cybertruck Depreciation

This one is tough to deal with, because the Cybertruck hasn’t been out very lengthy, with the primary deliveries occurring in January 2024.

That stated, for those who purchased a Cybertruck at MSRP again then, and took supply, there’s a very good probability that you can have really resold it for a revenue (assuming that you just weren’t frightened concerning the no resale clause within the Cybertruck contract).

That stated, the value of all Cybertrucks is coming down now, with the Basis AWD sequence promoting for lower than MSRP with tax, title, and license included now (let’s say $99k or decrease).

By this time subsequent 12 months, it’s affordable to say that you just may have the ability to decide up a Cybertruck within the $60k vary, which might quantity to no less than 40% depreciation or so, which continues to be vital, inside the first 12 months or two of possession for most individuals who obtained them early.

Tips on how to Keep away from (Or at Least Reduce) Depreciation on Your Tesla

Whereas depreciation is an inevitable a part of automobile possession, there are a number of methods you should utilize to reduce the influence in your Tesla’s worth.

In case you’re cautious and take note of these methods/factors, you may’t keep away from (or no less than reduce) among the worst elements in Tesla depreciation.

- Make Use of Native Incentives

Native incentives, akin to state rebates or utility firm reductions, can considerably cut back the preliminary buy value of your Tesla, which in flip may also help cushion the blow of depreciation. Many states supply rebates for buying electrical autos, and a few utility firms present further incentives for putting in house charging stations.

Generally these native incentives can actually add up, being $2,500 to $5,000 or much more, which may do loads to offset the hit of shopping for a brand new (or used) Tesla.

Remember to analysis the incentives obtainable in your space earlier than making a purchase order, as they’ll range extensively by location and should change over time.

- Make Use of Federal Tax Incentives

Along with native incentives, federal tax credit for electrical autos may assist cut back the preliminary price of your Tesla. Presently, the U.S. authorities gives a federal tax credit score of as much as $7,500 for qualifying new electrical autos, together with sure Tesla fashions (and $4,000 for qualifying used autos). Whereas these credit might part out or change sooner or later, they’ll present substantial financial savings on the time of buy, serving to to offset depreciation.

It’s vital to remain knowledgeable concerning the standing of federal tax credit, as the provision and quantity can change relying on authorities coverage and the variety of autos offered by a producer.

- Be Conscious of Tesla Pricing Actions

Tesla is thought for its unpredictable pricing changes, which may have a direct influence on the resale worth of your automobile. Staying knowledgeable about Tesla’s pricing developments may also help you make smarter shopping for choices. For instance, buying a Tesla throughout a interval of value stability, quite than instantly earlier than a value drop, may also help you keep away from sudden depreciation.

It’s additionally a good suggestion to observe Tesla’s bulletins and market circumstances carefully. If there are indicators {that a} value adjustment may be coming, you may time your buy or sale accordingly to reduce the influence in your automobile’s worth.

- Don’t Pay in Full for FSD

Whereas Tesla’s Full Self-Driving (FSD) characteristic is an thrilling prospect, and we positively assist their dedication to fixing autonomy, it’s vital to think about the potential influence in your automobile’s depreciation.

FSD is at the moment in a state of improvement, and its worth on the used market is considerably decrease than its upfront price. On the time of writing, FSD prices round $8,000 when bought outright, however it sometimes provides solely a fraction of that quantity to the resale worth of your Tesla ($1,000 – $2,000 at the moment).

To attenuate depreciation, take into account choosing a month-to-month FSD subscription as a substitute of buying it outright. This lets you profit from the characteristic with out locking in a big expense that might not be totally recouped if you promote your automobile.

- Purchase a Used Tesla (and Pay a Good Worth)

One of the vital efficient methods to reduce depreciation is to purchase a used Tesla as a substitute of a brand new one. Since new automobiles expertise the steepest depreciation within the first few years, buying a used Tesla means that you can keep away from that preliminary drop in worth.

Moreover, shopping for used usually means you may get extra automobile on your cash, because the earlier proprietor has already absorbed a lot of the depreciation.

When looking for a used Tesla, it’s vital to make sure you’re getting a good value. At Discover My Electrical, our platform connects consumers and sellers of used Teslas, providing detailed listings and a wide range of aggressive offers on a variety of fashions.

Take a look at our used EV listings to discover a deal on a used Tesla and avoid among the steepest depreciation!